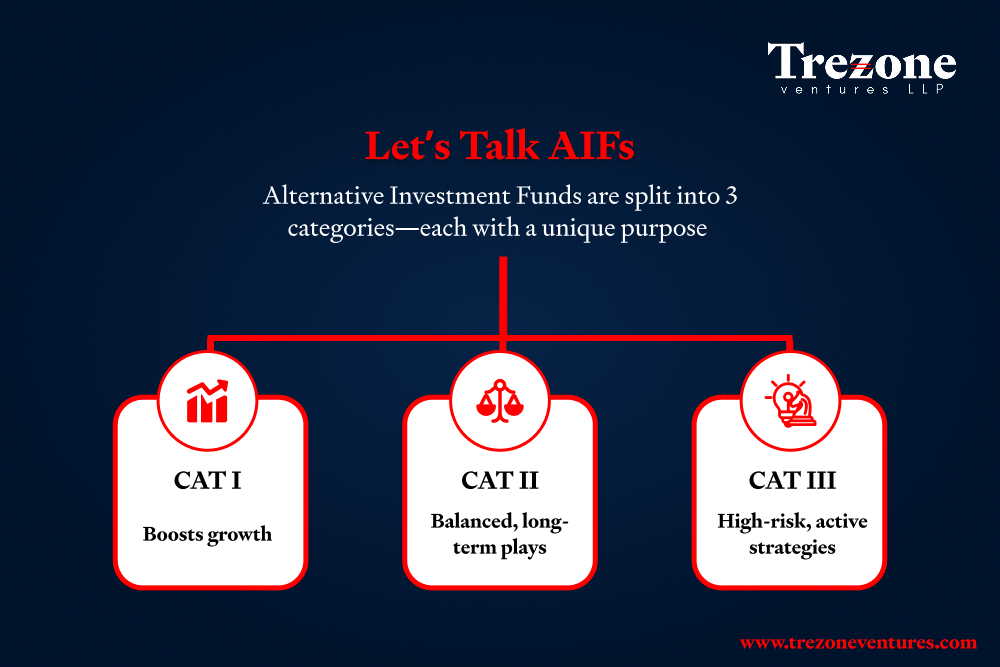

At Trezone Ventures LLP, we help investors navigate the world of Alternative Investment Funds (AIFs) by simplifying complex financial structures into actionable insights. Here’s a brief overview of the three key AIF categories defined by SEBI:

🔹 Category I AIF (CAT 1)

These funds focus on investments that benefit the economy and society, such as:

- Startups & Innovation-driven businesses

- Small and Medium Enterprises (SMEs)

- Infrastructure & Social impact ventures

Why Trezone Recommends It: CAT 1 AIFs are backed by regulatory support and tax benefits, making them ideal for long-term growth with a social impact.

Risk Level: Low to Medium

Investor Type: Visionary investors focused on sustainable development

🔹 Category II AIF (CAT 2)

These funds cover a broad spectrum of sectors, including:

- Private Equity

- Debt Instruments

- Real Estate

Why Trezone Recommends It: CAT 2 offers stable and diversified opportunities, often used for balanced portfolio strategies.

Risk Level: Moderate

Investor Type: Those seeking mid-term, diversified returns without speculative risk

🔹 Category III AIF (CAT 3)

These are dynamic, high-return funds that engage in:

- Trading in listed & unlisted derivatives

- Arbitrage & short-selling

- Leveraged strategies

Why Trezone Recommends It: Designed for sophisticated investors, CAT 3 AIFs pursue short-term gains through aggressive market strategies.

Risk Level: High

Investor Type: Experienced investors with high-risk appetite

✅ Trezone Ventures LLP – Your Trusted AIF Partner

Whether you’re looking to build wealth steadily, invest in impact-driven projects, or explore high-growth strategies, Trezone Ventures LLP offers expert guidance in aligning your investments with the right AIF category.

🔐 Trusted. Transparent. Tailored for You.

#AlternativeInvestmentFunds #CAT1AIF #CAT2AIF #CAT3AIF #TrezoneVentures #StartupInvesting #HighReturnInvestments #PrivateEquityIndia #HedgeFundsIndia #RealEstateFunds #SEBIRegistered #InvestmentStrategies #WealthManagement #DiversifiedPortfolio #SmartInvesting #VentureCapitalIndia #SafeInvestments #HNIFunds #IndiaInvestments #FinancialGrowth